Tuesday, July 5, 2011

0

Tuesday, July 5, 2011

abhi

read more

Integration of FI with MM and SD

All Materials in SAP have a material master and material master is the heart of all integration.

This material master has various views right from Basic views to Purchasing views, production, sales and distribution and accounting and controlling views. We will not get into the detail ofÂ

In the accounting view of Material master amongst other values we have a Valuation Class field. This Valuation class is the vital link which ensures that Accounting documents are posted automatically. Every material will have a valuation class field. Examples of Valuation Class could be Finished Goods,Semi Finished goods, Raw Material etc.

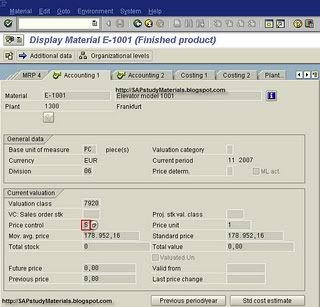

In transaction MM03, type in the material number and click on accounting 1 view - here the valuation class will be displayed.Â

All Material movements in MM happen with respect to a Movement Type. Â

For egÂ

Goods receipt is defined with movement type  - 101

Goods issue to production order is defined with movement type - 261

Scrapping of goods is defined with movement type - 551

Goods delivered to the customer with movement type - 601

Initial upload of stock is defined with movement type - 561

The combination of valuation class and the movement type helps in determining the GL accounts.Â

0

abhi

The Steps for Internal Order configuration are:

read more

SAP Internal Order Configuration - Screenshots

The Steps for Internal Order configuration are:

- Organizational Structure

- Order Master Data

- Planning

- Settlement

0

abhi

read more

Product Costing Accounting in SAP FI/CO

Product costing is used to calculate the cost of goods sold and manufactured for each unit of goods manufactured.

It is used to keep the track of cost at each and every point of production.

Costing sheet , cost component, Activity types and cost elements are used for product costing.

Costing sheet is used for the overheads purposes.

Cost Component is used for the breaking of expenses into various cost elements for more transparency of the cost structure.

Activity types are defined as per cost center.

The cost component split will give the transparency on the cost incurred on different levels such as machinery set up cost, labor costetc.

BOM is used to know the quantity of the material used for the production. Routing is used to define the sequence of steps required to perform certain operations. For Eg How many labor hours will be required for a finished product etc.

The entries which flow for product costing are as follows:

For Material issue

Raw Material Inventory(Credit)

To Raw Material Consumption (Debit)

Activities Performed

Respective cost center (Credit)

To Set Up cost (Debit)

Machining Cost (Debit)

Good Receipt

Cost of Production (Credit)

To Inventory of Finished Goods (Debit)

Please note that this entry will come from MM module and at Standard Price.

Settlement Of Production Order

Cost of Production( Variance)

To Price Difference Account

Post goods Issued

Inventory of Finished Goods (Credit)

To Cost of goods Sold (Debit)

It is used to keep the track of cost at each and every point of production.

Costing sheet , cost component, Activity types and cost elements are used for product costing.

Costing sheet is used for the overheads purposes.

Cost Component is used for the breaking of expenses into various cost elements for more transparency of the cost structure.

Activity types are defined as per cost center.

The cost component split will give the transparency on the cost incurred on different levels such as machinery set up cost, labor costetc.

BOM is used to know the quantity of the material used for the production. Routing is used to define the sequence of steps required to perform certain operations. For Eg How many labor hours will be required for a finished product etc.

The entries which flow for product costing are as follows:

For Material issue

Raw Material Inventory(Credit)

To Raw Material Consumption (Debit)

Activities Performed

Respective cost center (Credit)

To Set Up cost (Debit)

Machining Cost (Debit)

Good Receipt

Cost of Production (Credit)

To Inventory of Finished Goods (Debit)

Please note that this entry will come from MM module and at Standard Price.

Settlement Of Production Order

Cost of Production( Variance)

To Price Difference Account

Post goods Issued

Inventory of Finished Goods (Credit)

To Cost of goods Sold (Debit)

0

abhi

read more

SAP CO Consultant Certification

Certification Test

SAP Consultant Certification Solution Consultant Financials -

Management Accounting with my SAP ERP 2005

Software

* Software components: SAP ERP Central Component 6.0

Number of Questions

80

Duration

180 minutes

Notes

* Please note that you are not allowed to use any reference

materials during the certification test (no access to online

documentation or to any SAP system).

* The certification test Solution Consultant Financials -

Management Accounting with my SAP ERP 2005 verifies the knowledge in

the area of the mySAP ERP Financials for the consultant profile

Management Accounting. This certificate proves that the candidate has

a basic understanding within this consultant profile, and can

implement this knowledge practically in projects.

Competency Areas

The following list helps you to identify the competency areas covered

in this test. The percentage indicates the portion of the test

dedicated to a particular competency area.

Competency

Material Cost Estimate With Quantity Structure

Analyses and error handling TFIN20 AC505

BOM TFIN20 AC505

BOM and task list determination TFIN20 AC505

Cost component split TFIN20 AC505

Costing variant TFIN20 AC505

Create costing run TFIN20 AC505

Overhead costing sheet TFIN20 AC505

Price update TFIN20 AC505

Routing TFIN20 AC505

Cost Center Accounting / Profit Center Accounting

Account assignment help TFIN20 AC405

Accrual calculation TFIN20 AC405

Adjustment postings TFIN20 AC405

Assessment TFIN20 AC405

Direct activity allocation TFIN20 AC405

Distribution TFIN20 AC405

Integrated plan allocation cycle TFIN20 AC405 AC040

Introduction to planning in Management Accounting TFIN20 AC405 AC040

Master data cost elements, cost centers, activity types and stat

TFIN20 AC405

Organizational units TFIN20 AC405 AC040

Periodic reposting TFIN20 AC405 AC040

Planning methods in cost center planning TFIN20 AC405

Profit center assignment TFIN20 AC610

Profit center master data TFIN20 AC610

Reconciliation ledger TFIN20 AC405

Recording primary postings TFIN20 AC405

Cost Object Accounting: Make-to-Stock Production with Periodic C

Decoupling scenarios TFIN22 AC520

Period-end closing for periodic Controlling TFIN22 AC520

Preliminary costing on cost object TFIN22 AC520

Product cost collector TFIN22 AC520

Simultaneous costing on cost object TFIN22 AC520

Cost Object Controlling: Make-to-Stock Production with Order Con

11-20%

Cost objects with order view TFIN22 AC520

Period-end closing with order Controlling TFIN22 AC520

Preliminary costing of cost objects TFIN22 AC520

Simultaneous costing TFIN22 AC520

Cost Object Controlling: Sales-Order-Related Production

Delivery and billing documents TFIN22 AC520

Period-end closed with product cost by sales order TFIN22 AC520

Preliminary costing of sales order TFIN22 AC520

Sales order as cost object TFIN22 AC520

Simultaneous costing of sales order TFIN22 AC520

Material Cost Estimate Without Quantity Structure

Base object costing and simulation costing TFIN20 AC505

Material master - fields relevant to costing TFIN20 AC505

Multiple-level unit costing TFIN20 AC505

Single-level unit costing TFIN20 AC505

Overhead Cost Orders

Billing for overhead cost orders TFIN20 AC405

Budgeting and availability control TFIN20 AC405

Commitments management TFIN20 AC405

Master data maintenance TFIN20 AC405

Overhead rates on overhead cost orders TFIN20 AC405

Source:

http://www.sap.com/services/education/certification/

SAP Consultant Certification Solution Consultant Financials -

Management Accounting with my SAP ERP 2005

Software

* Software components: SAP ERP Central Component 6.0

Number of Questions

80

Duration

180 minutes

Notes

* Please note that you are not allowed to use any reference

materials during the certification test (no access to online

documentation or to any SAP system).

* The certification test Solution Consultant Financials -

Management Accounting with my SAP ERP 2005 verifies the knowledge in

the area of the mySAP ERP Financials for the consultant profile

Management Accounting. This certificate proves that the candidate has

a basic understanding within this consultant profile, and can

implement this knowledge practically in projects.

Competency Areas

The following list helps you to identify the competency areas covered

in this test. The percentage indicates the portion of the test

dedicated to a particular competency area.

Competency

Material Cost Estimate With Quantity Structure

Analyses and error handling TFIN20 AC505

BOM TFIN20 AC505

BOM and task list determination TFIN20 AC505

Cost component split TFIN20 AC505

Costing variant TFIN20 AC505

Create costing run TFIN20 AC505

Overhead costing sheet TFIN20 AC505

Price update TFIN20 AC505

Routing TFIN20 AC505

Cost Center Accounting / Profit Center Accounting

Account assignment help TFIN20 AC405

Accrual calculation TFIN20 AC405

Adjustment postings TFIN20 AC405

Assessment TFIN20 AC405

Direct activity allocation TFIN20 AC405

Distribution TFIN20 AC405

Integrated plan allocation cycle TFIN20 AC405 AC040

Introduction to planning in Management Accounting TFIN20 AC405 AC040

Master data cost elements, cost centers, activity types and stat

TFIN20 AC405

Organizational units TFIN20 AC405 AC040

Periodic reposting TFIN20 AC405 AC040

Planning methods in cost center planning TFIN20 AC405

Profit center assignment TFIN20 AC610

Profit center master data TFIN20 AC610

Reconciliation ledger TFIN20 AC405

Recording primary postings TFIN20 AC405

Cost Object Accounting: Make-to-Stock Production with Periodic C

Decoupling scenarios TFIN22 AC520

Period-end closing for periodic Controlling TFIN22 AC520

Preliminary costing on cost object TFIN22 AC520

Product cost collector TFIN22 AC520

Simultaneous costing on cost object TFIN22 AC520

Cost Object Controlling: Make-to-Stock Production with Order Con

11-20%

Cost objects with order view TFIN22 AC520

Period-end closing with order Controlling TFIN22 AC520

Preliminary costing of cost objects TFIN22 AC520

Simultaneous costing TFIN22 AC520

Cost Object Controlling: Sales-Order-Related Production

Delivery and billing documents TFIN22 AC520

Period-end closed with product cost by sales order TFIN22 AC520

Preliminary costing of sales order TFIN22 AC520

Sales order as cost object TFIN22 AC520

Simultaneous costing of sales order TFIN22 AC520

Material Cost Estimate Without Quantity Structure

Base object costing and simulation costing TFIN20 AC505

Material master - fields relevant to costing TFIN20 AC505

Multiple-level unit costing TFIN20 AC505

Single-level unit costing TFIN20 AC505

Overhead Cost Orders

Billing for overhead cost orders TFIN20 AC405

Budgeting and availability control TFIN20 AC405

Commitments management TFIN20 AC405

Master data maintenance TFIN20 AC405

Overhead rates on overhead cost orders TFIN20 AC405

Source:

http://www.sap.com/services/education/certification/

0

abhi

read more

SAP FI Consultant Certification

Certification Test

SAP Consultant Certification Solution Consultant Financials -

Financial Accounting with mySAP ERP 2005

Software

* Software components: SAP ERP Central Component 6.0

Number of Questions

80

Duration

180 minutes

Notes

* Please note that you are not allowed to use any reference

materials during the certification test (no access to online

documentation or to any SAP system).

* The certification test Solution Consultant Financials -

Financial Accounting with mySAP ERP 2005 verifies the knowledge in the

area of mySAP ERP Financials for the consultant profile Financial

Accounting. This certificate proves that the candidate has a basic

understanding within this consultant profile, and can implement this

knowledge practically in projects.

Competency Areas

The following list helps you to identify the competency areas covered

in this test. The percentage indicates the portion of the test

dedicated to a particular competency area.

Competency

-Asset Accounting (AC305)

-Closing Operations in Financial Accounting (AC205)

-Document and Posting Control (Ac200)

-Evaluation Options in Reporting (AC280)

-Financial Accounting Master Data (AC200)

-Payment Program, Dunning Program, Correspondence, Interest Calcu (AC201))

-SAP Overview (ERP020)

-SAP Solution Manager (SM01)

-Special General Ledger Transactions, Document Parking, Substitut(AC202)

-The New General Ledger(AC210)

Source:

http://www.sap.com/services/education/certification/

SAP Consultant Certification Solution Consultant Financials -

Financial Accounting with mySAP ERP 2005

Software

* Software components: SAP ERP Central Component 6.0

Number of Questions

80

Duration

180 minutes

Notes

* Please note that you are not allowed to use any reference

materials during the certification test (no access to online

documentation or to any SAP system).

* The certification test Solution Consultant Financials -

Financial Accounting with mySAP ERP 2005 verifies the knowledge in the

area of mySAP ERP Financials for the consultant profile Financial

Accounting. This certificate proves that the candidate has a basic

understanding within this consultant profile, and can implement this

knowledge practically in projects.

Competency Areas

The following list helps you to identify the competency areas covered

in this test. The percentage indicates the portion of the test

dedicated to a particular competency area.

Competency

-Asset Accounting (AC305)

-Closing Operations in Financial Accounting (AC205)

-Document and Posting Control (Ac200)

-Evaluation Options in Reporting (AC280)

-Financial Accounting Master Data (AC200)

-Payment Program, Dunning Program, Correspondence, Interest Calcu (AC201))

-SAP Overview (ERP020)

-SAP Solution Manager (SM01)

-Special General Ledger Transactions, Document Parking, Substitut(AC202)

-The New General Ledger(AC210)

Source:

http://www.sap.com/services/education/certification/

0

abhi

read more

What is Company Code? in SAP

Company Code is a unique four alphanumeric characters that represents an independent and legal accounting entity. It's the smallest and minimum necessary organizational structure in SAP that required by law to provide a set of financial reports (such as Balance Sheet and Profit/Loss Statements). In the real world, a company code can be a company of a corporate group. In an SAP client, there can be one or several company codes. The general ledger is kept at company code level. For consolidation process in SAP EC module, a company code must be assigned to a company. A company can comprise one or more company codes.

With SAP FI module, we can generate the financial reports of a company code. A company code's financial reports are used for external purpose, such as for external auditors, shareholders/stock exchange commission, tax office, etc.

Company code is one of the two main organizational units of SAP FI module. The other one is Business Area. Business areas are used for internal purpose, such as for company's management. Business areas represent separate areas of operation within one or some companies. With business areas, for example, SAP can generate financial reports of a specific regional area of a company.

Let's say ABC company has one company code in USA (and several company codes in the whole world). With company code, SAP can only generate one set of financial reports for USA office. But, with business areas (depends on how it configured), SAP can generate sets of financial reports per state in the USA. By doing so, the management can analyze the performance of each branch in each state better. It gives more useful information that can be used in decision making process. The use of Business Areas is optional in SAP FI module.All SAP transactions that have impact to the financial reports from all SAP modules (such as FI, MM, HR, etc) will generate accounting journals in company code's general ledger.

The transaction can determine the company code involved either from the user input for the company code (such as in FI module) or from other organizational unit that related to the company code (such as in MM module, company code can be determined from the plant that input by user).

In MM module (Logistics), each plant must be assigned to a company code. A company code can have several plants.

A plant can also be assigned to a business area. A business area can be assigned to several plants.

Material valuation can be set at company code level or plant.

SAP FICO Company code configuration

SPRO path for company code creation

With SAP FI module, we can generate the financial reports of a company code. A company code's financial reports are used for external purpose, such as for external auditors, shareholders/stock exchange commission, tax office, etc.

Company code is one of the two main organizational units of SAP FI module. The other one is Business Area. Business areas are used for internal purpose, such as for company's management. Business areas represent separate areas of operation within one or some companies. With business areas, for example, SAP can generate financial reports of a specific regional area of a company.

Let's say ABC company has one company code in USA (and several company codes in the whole world). With company code, SAP can only generate one set of financial reports for USA office. But, with business areas (depends on how it configured), SAP can generate sets of financial reports per state in the USA. By doing so, the management can analyze the performance of each branch in each state better. It gives more useful information that can be used in decision making process. The use of Business Areas is optional in SAP FI module.All SAP transactions that have impact to the financial reports from all SAP modules (such as FI, MM, HR, etc) will generate accounting journals in company code's general ledger.

The transaction can determine the company code involved either from the user input for the company code (such as in FI module) or from other organizational unit that related to the company code (such as in MM module, company code can be determined from the plant that input by user).

In MM module (Logistics), each plant must be assigned to a company code. A company code can have several plants.

A plant can also be assigned to a business area. A business area can be assigned to several plants.

Material valuation can be set at company code level or plant.

SAP FICO Company code configuration

SPRO path for company code creation

0

abhi

read more

SAP FI GL CONFIGURATION

These are the steps in GL configuration.

1. Creating company code

2. Create chart of accounts

3. Assign company code to chart of accounts

4. Define Account group

5. Define retained earnings Account

6. Maintain Fiscal year variant

7. Assign company code to a Fiscal year variant

8. Define Posting Period variant

9. Define variants for open periods posting

10. Assign Posting period variant to company Code

11. Create document number ranges for company code

12. Define document type and assign document number range

13. Enable Fiscal year default

14. Enable default value date

15. Maintain field status variants

16. Assign company code to field status variants

17. Screen variants for document entry

1. Creating company code

2. Create chart of accounts

3. Assign company code to chart of accounts

4. Define Account group

5. Define retained earnings Account

6. Maintain Fiscal year variant

7. Assign company code to a Fiscal year variant

8. Define Posting Period variant

9. Define variants for open periods posting

10. Assign Posting period variant to company Code

11. Create document number ranges for company code

12. Define document type and assign document number range

13. Enable Fiscal year default

14. Enable default value date

15. Maintain field status variants

16. Assign company code to field status variants

17. Screen variants for document entry

0

abhi

read more

Finance Terms in SAP FI

Client: In commercial, organizational and technical terms, a self-contained unit in an R/3 System with separate master records and its own set of tables.

Company Code: The smallest organizational unit of Financial Accounting for which a complete self-contained set of accounts can be drawn up for purposes of external reporting.

Business Area: An organizational unit of financial accounting that represents a separate area of operations or responsibilities within an organization and to which value changes recorded in Financial Accounting can be allocated.

Enterprise structure: A portrayal of an enterprise's hierarchy. Logical enterprise structure, including the organizational units required to manage the SAP System such as plant or cost center.

Social enterprise structure, description of the way in which an enterprise is organized, in divisions or user departments. The HR application component portrays the social structure of an enterprise

fiscal year variant: A variant defining the relationship between the calendar and fiscal year. The fiscal year variant specifies the number of periods and special periods in a fiscal year and how the SAP System is to determine the assigned posting periods.

Fiscal Year: A period of usually 12 months, for which the company produces financial statements and takes inventory.

Annual displacement/Year shift: For the individual posting periods various entries may be necessary. For example, in the first six periods the fiscal year and calendar year may coincide, whereas for the remaining periods there may be a displacement of +1.

Chart of Accounts: Systematically organized list of all the G/L account master records that are required in a company codes. The COA contains the account number, the account name and control information for G/L account master record.

Financial statement version: A hierarchical positioning of G/L accounts. This positioning can be based on specific legal requirements for creating financial statements. It can also be a self-defined order.

Account group: An object that attributes that determine the creation of master records. The account group determines: The data that is relevant for the master record A number range from which numbers are selected for the master records.

Field status group: Field status groups control the additional account assignments and other fields that can be posted at the line item level for a G/L account.

Posting Key: A two-digit numerical key that determines the way line items are posted. This key determines several factors including the: Account type, Type of posting (debit or credit),Layout of entry screens .

Open item management: A stipulation that the items in an account must be used to clear other line items in the same account. Items must balance out to zero before they can be cleared. The account balance is therefore always equal to the sum of the open items.

Clearing: A procedure by which the open items belonging to one or more accounts are indicated as cleared (paid).

Reconciliation account: A G/L account, to which transactions in the subsidiary ledgers (such as in the customer, vendor or assets areas) are updated automatically.

Special G/L indicator: An indicator that identifies a special G/L transaction. Special G/L transactions include down payments and bills of exchange.

Special G/L transaction: The special transactions in accounts receivable and accounts payable that are shown separately in the general ledger and sub-ledger.

They include:

- Bills of exchange

- Down payments

- Guarantees

House Bank: A business partner that represents a bank through which you can process your own internal transactions.

Document type: A key that distinguishes the business transactions to be posted. The document type determines where the document is stored as well as the account types to be posted.

Account type: A key that specifies the accounting area to which an account belongs.

Examples of account types are:

- Asset accounts

- Customer accounts

- Vendor accounts

- G/L accounts

Dunning procedure: A pre-defined procedure specifying how customers or vendors are dunned.

For each procedure, the user defines

- Number of dunning levels

- Dunning frequency

- Amount limits

- Texts for the dunning notices

Dunning level: A numeral indicating how often an item or an account has been dunned.

Dunning key: A tool that identifies items to be dunned separately, such as items you are not sure about or items for which payment information exists.

Year-end closing: An annual balance sheet and profit and loss statement, both of which must be created in accordance with the legal requirements of the country in question.

Standard accounting principles require that the following be listed:

- All assets

- All debts, accruals, and deferrals

- All revenue and expenses

Month-end closing: The work that is performed at the end of a posting period.

Functional area: An organizational unit in Accounting that classifies the expenses of an organization by functions such as:

- Administration

- Sales and distribution

- Marketing

- Production

- Research and development

Classification takes place to meet the needs of cost-of-sales accounting.

Noted item: A special item that does not affect any account balance. When you post a noted item, a document is generated. The item can be displayed using the line item display. Certain noted items are processed by the payment program or dunning program - for example, down payment requests.

Accrual and deferral: The assignment of an organization's receipts and expenditure to particular periods, for purposes of calculating the net income for a specific period.

A distinction is made between:

- Accruals -

An accrual is any expenditure before the closing key date that represents an expense for any period after this date.

- Deferral -

Deferred income is any receipts before the closing key date that represent revenue for any period after this date.

Statistical posting: The posting of a special G/L transaction where the offsetting entry is made to a specified clearing account automatically (for example, received guarantees of payment).

Statistical postings create statistical line items only.

Valuation area: An organizational unit in Logistics subdividing an enterprise for the purpose of uniform and complete valuation of material stocks.

Chart of depreciation: An object that contains the defined depreciation areas. It also contains the rules for the evaluation of assets that are valid in a specific country or economic area. Each company code is allocated to one chart of depreciation. Several company codes can work with the same chart of depreciation. The chart of depreciation and the chart of accounts are completely independent of one another.

Asset class: The main criterion for classifying fixed assets according to legal and management requirements.

For each asset class, control parameters and default values can be defined for depreciation calculation and other master data.

Each asset master record must be assigned to one asset class.

Special asset classes are, for example:

- Assets under construction

- Low-value assets

- Leased assets

- Financial assets

- Technical assets

Depreciation area: An area showing the valuation of a fixed asset for a particular purpose (for example, for individual financial statements, balance sheets for tax purposes, or management accounting values).

Depreciation key: A key for calculating depreciation amounts.

The depreciation key controls the following for each asset and for each depreciation area:

- Automatic calculation of planned depreciation

- Automatic calculation of interest

- Maximum percentages for manual depreciation

The depreciation key is defined by specifying:

- Calculation methods for ordinary and special depreciation, for interest and for the cutoff value

- Various control parameters

Period control method: A system object that controls what assumptions the system makes when revaluating asset transactions that are posted partway through a period.

Using the period control method, for example, you can instruct the system only to start revaluating asset acquisitions in the first full month after their acquisition.

The period control method allows different sets of rules for different types of asset transactions, for example, acquisitions and transfers.

Depreciation base: The base value for calculating periodic depreciation.

The following base values are possible, for example:

- Acquisition and production costs

- Net book value

- Replacement value

0

abhi

read more

Controlling Terms in SAP CO

Controlling Area: An organizational unit within a company, used to represent a closed system for cost accounting purposes. A controlling area may include single or multiple company codes that may use different currencies. These company codes must use the same operative chart of accounts.

Cost center std Hierarchy : Indicated hierarchy of cost center groups in which all cost centers in a controlling area are gathered together.

Cost element : A cost element classifies the organization's valuated consumption of production factors within a controlling area. A cost element corresponds to a cost-relevant item in the chart of accounts.

Primary cost element: A cost element whose costs originate outside of CO and accrual costs that are used only for controlling purposes

Secondary cost element: A cost element that is used to allocate costs for internal activities. Secondary cost elements do not correspond to any G/L account in Financial Accounting. They are used only in Controlling and consequently cannot be defined in FI as an account.

Cost element category: The classification of cost elements according to their usage or origin.

Examples of cost element categories are:

- Material cost elements

- Settlement cost elements for orders

Cost elements for allocating internal activities

Reconciliation ledger: A ledger used for summarized display of values that appear in more detailed form in the transaction data.

The reconciliation ledger has the following functions:

- Reconciles Controlling with Financial Accounting: The reconciliation ledger provides reports for monitoring the reconciliation of Controlling with Financial Accounting by account.

- It can identify and display value flows in Controlling across company code, functional area, or business area boundaries

- Provides an overview of all costs incurred : Reconciliation ledger reports provide an overview of the costs and are therefore a useful starting point for cost analysis. For example, an item in the profit and loss statement from the Financial Information System (FIS) can be examined in the reconciliation ledger reports with respect to the relevant costs. For more detailed analysis, reports from other components within Controlling can be accessed from the reconciliation ledger reports.

Cost Center: An organizational unit within a controlling area that represents a defined location of cost incurrence.

The definition can be based on:

- Functional requirements

- Allocation criteria

- Physical location

- Responsibility for costs

Cost center category: An attribute that determines the type of cost center.

Example

- F - Production cost center

- H - Service cost center

Controlling area: An organizational unit within a company, used to represent a closed system for cost accounting purposes.

A controlling area may include single or multiple company codes that may use different currencies. These company codes must use the same operative chart of accounts.

All internal allocations refer exclusively to objects in the same controlling area.

Statistical key figure: The statistical values describing:

- Cost centers

- Orders

- Business processes

- Profit centers

There are the following types of statistical key figures:

- Fixed value - Fixed values are carried forward from the current posting period to all subsequent periods.

- Total value -

Totals values are posted in the current posting period only

Activity type: A unit in a controlling area that classifies the activities performed in a cost center.

Example

Activity types in production cost centers are machine hours or finished units.

Allocation cost element : A cost element used to illustrate activity allocation in terms of values. The allocation cost element is a secondary cost element , under which the activity type or business process is allocated.

The allocation cost element is the central characteristic used in all CO postings. It is therefore also an important criterion for reporting - for example, many reports are structured according to the posted cost elements.

Assessment cost element: A secondary cost element for costs that are assessed between Controlling objects.Reposting: A posting aid in which primary costs are posted to a receiver object under the original cost element (the cost element of the sender object).

Repostings are used to rectify incorrect postings. The following methods are available:

- Transaction-based reposting -

Each posting is made in real time during the current period.

- Periodic reposting -

Produces the same results as transaction-based reposting. The costs being transferred are collected on a clearing cost center and then transferred at the end of the period according to allocation bases defined by the user.

Distribution: A business transaction that allocates primary costs.

- The original cost element is retained in the receiver cost center.

- Information about the sender and the receiver is documented in the Controlling document.

Assessment: A method of internal cost allocation by which you allocate the costs of a sender cost center to receiver CO objects (such as orders and other cost centers) using an assessment cost element.

The SAP System supports the following:

- Hierarchical method (where the user determines the assessment sequence)

- Iterative method (where the SAP System determines the sequence of assessment using iteration).

Example:

The costs from the cafeteria cost center could be assessed based on the statistical key figure "employee", which was set up on the receiver cost center.

Receiver cost center I has 10 employees, receiver cost center II has 90. The costs of the cafeteria cost center would be transferred (assessed) to receiver cost center I (10%) and receiver cost center II (90%). The credit on the cafeteria cost center and the debit of the two receiver cost centers are posted using an assessment cost element. Depending on the system setting, the total costs or some of the costs for the cafeteria cost center would be

Internal order: An instrument used to monitor costs and, in some instances, the revenues of an organization.

Internal orders can be used for the following purposes:

- Monitoring the costs of short-term jobs

- Monitoring the costs and revenues of a specific service

- Ongoing cost control

Internal orders are divided into the following categories:

- Overhead orders - For short-term monitoring of the indirect costs arising from jobs. They can also be used for continuous monitoring of subareas of indirect costs. Overhead orders can collect plan and actual costs independently of organizational cost center structures and business processes, enabling continuous cost control in the enterprise.

- Investment orders - Monitor investment costs that can be capitalized and settled to fixed assets.

- Accrual orders - Monitor period-based accrual between expenses posted in Financial Accounting and accrual costs in Controlling.

- Orders with revenues - Monitor the costs and revenues arising from activities for partners outside the organization, or from activities not belonging to the core business of the organization.

Order type: A tool that categorizes orders according to purpose.

The order type contains information which is necessary for managing orders. Order types are client-specific. The same order type can be used in all controlling areas in one client.

Example

- Production orders

- Maintenance orders

- Capital investment orders

- Marketing orders

Cost of sales accounting: A type of profit and loss statement that matches the sales revenues to the costs or expenses involved in making the revenue (cost of sales).

The expenses are listed in functional areas such as:

- Manufacturing

- Management

- Sales and distribution

- Research and development

Cost of sales accounting displays how the costs were incurred. It represents the economic outflow of resources.

0

abhi

read more

SPRO path for Company Code Creation in SAP FI

Detailed description of Company code

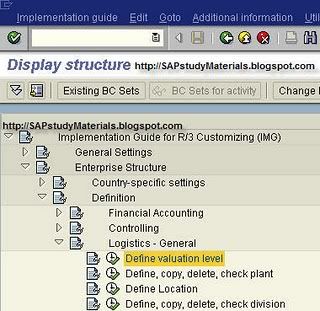

We create company code from the following menu path of "SPRO" t-code:

Enterprise Structure - > Definition - > Financial Accounting - > Edit, Copy, Delete, Check Company

Code.There are two options to create company code:

Copy from other company code (or from SAP standard company code)

Create from the scratch

SAP recommends that we copy a company code from an existing company code. The advantage is SAP will also copy the existing company code-specific parameters. Then we can change certain data in the relevant application if necessary. This is much less time-consuming than creating a new company code.

Check out the video to create from scratch http://www.youtube.com/watch?v=Od7fSxnJ1ro

Company code configuration

We create company code from the following menu path of "SPRO" t-code:

Enterprise Structure - > Definition - > Financial Accounting - > Edit, Copy, Delete, Check Company

Code.There are two options to create company code:

Copy from other company code (or from SAP standard company code)

Create from the scratch

SAP recommends that we copy a company code from an existing company code. The advantage is SAP will also copy the existing company code-specific parameters. Then we can change certain data in the relevant application if necessary. This is much less time-consuming than creating a new company code.

Check out the video to create from scratch http://www.youtube.com/watch?v=Od7fSxnJ1ro

Company code configuration

0

abhi

Characteristic of Price Control “Sâ€:

Characteristic of Price Control “Vâ€.

Material Valuation in SAP MM

Material valuation is one of the “must-know†topics for all SAP Material Management (MM) learners, especially for MM consultant, FI consultant, and FI & MM administrator in a company. In a company, the material valuation procedure must be determined together with accounting department. It determines, among other things, how a material transaction recorded in accounting journal.

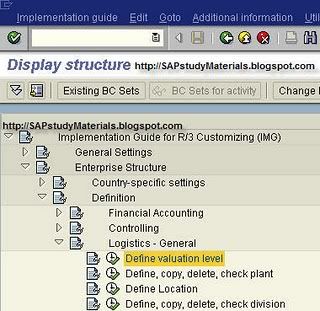

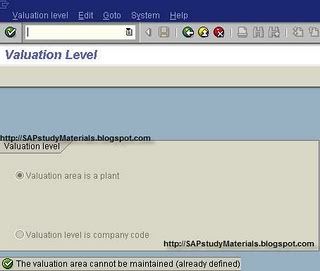

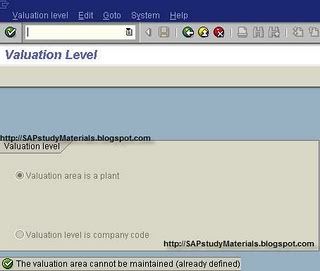

The first thing that we should know in material valuation is the Valuation Area. It is the organizational level at which material is valuated. In SAP R/3 system, there are two possible organizational level at which material is valuated:

1. Plant.

When stock is valuated at plant level, we can evaluate a material in different plants at different prices. Valuation must be at this level in the following cases:

When stock is valuated at plant level, we can evaluate a material in different plants at different prices. Valuation must be at this level in the following cases:

· If we want to use the application component Production Planning (PP) or Costing

· If our system is a SAP Retail system

2. Company Code.

When stock is valuated at company code level, the valuation price of a material is the same in all of a company's plants (that is, in a company code).

When stock is valuated at company code level, the valuation price of a material is the same in all of a company's plants (that is, in a company code).

SAP recommends that we set material valuation at Plant level.

We can define the valuation level in configuration process with T-Code SPRO and will be valid for whole client. The configuration process can be seen at these screen shots:

We can define the valuation level in configuration process with T-Code SPRO and will be valid for whole client. The configuration process can be seen at these screen shots:

If we’ve never defined this before, the “Valuation Level†screen will be editable, but in this example it is not editable because it has been defined before. Defining the valuation level in Configuring is a fundamental setting, and is very difficult to reverse.

The transactions in Inventory Management that can affect the valuation price of material in accounting record (depending on the type of price control) are:

· Goods Receipts.

· Goods Issues.

· Transfer Postings (for example, a stock transfer between two plants or a transfer posting from one material to another).

· Postings in Invoice Verification.

We must create the accounting data for each valuation area for all valuated materials so the above transactions can be carried out for those materials. In the accounting view of material master data, we can get an overview of the present valuation.

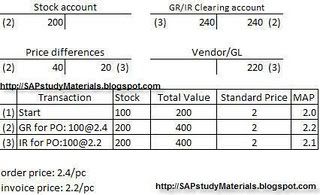

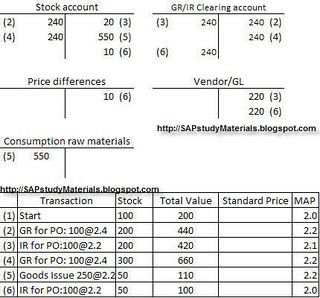

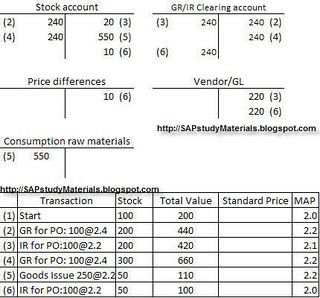

Valuation of goods receipts depends on the price control procedure we set in the material master record. In the R/3 System, material valuation can be carried out according to the moving average price procedure (V price) or the standard price procedure (S price).

In the standard price procedure (price control “Sâ€), the system carries out all stock postings at a price defined in the material master. Variances are posted to price difference accounts.

In the moving average price procedure (price control “Vâ€), the system valuates goods receipts with the purchase order price and goods issues with the current moving average price. The system automatically calculates the latter upon every goods movement by dividing the total value by the total stock quantity. Differences between the purchase order price and the invoice are posted directly to the relevant stock account if there is sufficient stock coverage.

Characteristic of Price Control “Sâ€:

· All stock postings are made at a standard price.

· The system posts all differences from the standard price to an account “Expense/Revenue from price differenceâ€.

· Exact values are available for cost accounting / controlling purposes (All goods issues, such as issues to a production order, are evaluated at the same standard price. This allows better analysis of the costs of production orders).

· In the accounting view, we can display differences between the delivered price and the standard price.

· We can change material prices if required (generally at the end of period). This causes the system to revaluate the total stock for a valuation area.

A receipt posted to a stock account is generally posted at the standard price. Differences between the order price and the standard price are posted to an “Expenses/revenue from price differences†account (2).

Differences between the invoice price and the order price are posted to an “Expenses/revenue from price differences†account (3).

The moving average price is also recorded in the material master when the material is valuated at a standard price. It indicates the extent to which the standard price differs from the delivered price.

Characteristic of Price Control “Vâ€.

· Receipts are evaluated at their actual price (as per purchase order, invoices,...)

· The system modifies the price in the material in the material master according to the delivered price.

· Issues are generally valuated at the current material price.

· The data used for cost accounting / controlling purposes therefore contains price fluctuations.

· Only in exceptional circumstances does the system post at a difference to the “Expenses/Revenues from price differences†account (The system makes a posting to an “Expenses/revenue from price differences†account for a material valuated at a moving average price only in the case of a debit or credit when the stock coverage in the company code is smaller than the quantity to be debited or credited, e.g.: When we reverse an invoice, the account movements made when the invoice was posted cannot always simply be reversed. For example, if there was sufficient stock coverage when we posted an invoice with a price variance for a material with moving average price, but when we reverse the invoice, there is insufficient stock coverage, the R/3 System posts the price difference in the credit memo to a price difference account, although the price variance was debited to the stock account when we posted the invoice)

· We can change material prices if required (generally at the end of period). This causes the system to revaluate the total stock for a valuation area.

Postings at Moving Average Price.

Receipts to the stock account are posted with the value Quantity x Order price. The moving average price is recalculated after every transaction and is therefore adjusted in line with delivered prices (2)/(4).

Differences between the order price and the invoice price are debited to the stock account, as the invoiced quantity is in stock (3).

The difference between the order price and the invoice price is only posted for the 50 pieces in stock. For the remaining 50 pieces that are not in stock, the difference between the order price and the invoice price is posted to an “Expenses/revenue from price differences†account (6).

Receipts to the stock account are posted with the value Quantity x Order price. The moving average price is recalculated after every transaction and is therefore adjusted in line with delivered prices (2)/(4).

Differences between the order price and the invoice price are debited to the stock account, as the invoiced quantity is in stock (3).

The difference between the order price and the invoice price is only posted for the 50 pieces in stock. For the remaining 50 pieces that are not in stock, the difference between the order price and the invoice price is posted to an “Expenses/revenue from price differences†account (6).

Subscribe to:

Posts (Atom)